Navy Government Borrowing Relationship try a card connection you to definitely works away from Vienna, Virginia, in the usa. The college even offers different sorts of services and products, like the Navy Government Borrowing from the bank Commitment unsecured loan you to definitely professionals loans Briggsdale CO can be sign up for multiple spends instance team invention, fee out of health charges, college fees, repair from property, and much more. Navy Government Credit Commitment is even entitled Navy Government. Since the its business, the organization players have increased from 7 to around ten mil.

The credit partnership operates underneath the regulation of the Federal Borrowing Connection Administration (NCUA). You handles, charters, and you may supervises government borrowing unions to ensure that it operate fairly. We all know whenever creditors run in the place of statutes, certain can start exploiting their customers because of the battery charging highest interest levels and you can and then make a lot of write-offs to their currency. I have observed borrowing from the bank unions you to disappeared along with their customers’ currency truth be told there in advance of, and more than governing bodies of the globe possess put down rigid guidelines on the creditors.

In the event that credit partnership become their businesses inside 1933, it had been known as the Navy Service Employees’ Borrowing Connection. Simply Navy Service personnel on the federal employees’ work commitment and you may their family participants were eligible to sign up during that time. Yet not, later on for the 1954, the credit connection altered its constitution to provide Navy and you may , the financing partnership unsealed doorways getting Navy builders to join him or her. Afterwards in 2008, the new members of the newest Company out of Security was indeed plus permitted to enter.

Five some thing visitors will get incorrect in the Navy Government Borrowing Relationship private fund

There are many impression that folks features towards Navy Federal Credit Union which aren’t real. The 5 issues that anyone go awry about the Navy Federal Credit Commitment personal loans are listed below.

1) That credit partnership costs higher interest rates

Because most finance companies and other financial institutions has actually high rates that may rise so you’re able to thirty-six%, some one often genuinely believe that the fresh new Navy Government Credit Commitment personal funds provides like higher prices. Yet not, the credit relationship offers signature loans that have low interest rates from doing 18%. It generates they one of the better borrowing unions for personal financing.

There’s a lot regarding rescuing after you discover unsecured loans regarding commitment than the anyone else. Such as for instance, for people who submit an application for a great $10,100000 financing on credit relationship to settle in this 36 months, you are going to pay $thirteen,014 in total, which is far low as compared to $sixteen,489 you could have paid back with a beneficial thirty six% Annual percentage rate from other establishments.

not, it doesn’t indicate that the credit relationship costs could be the best. There are many associations that have far lower Annual percentage rate by which people with excellent credit scores should try the luck to reduce the general cost.

2) You to players do not require safety so you can acquire signature loans

/82004edb-6149-4d43-b8e0-de70427b94f5.png)

Individuals think that you should buy a personal loan rather than to provide one safety thoughts is broken a beneficial Navy Federal Borrowing Union representative. The truth is that your credit ratings see whether might score an unsecured loan or perhaps not. For good fico scores, one can score signature loans.

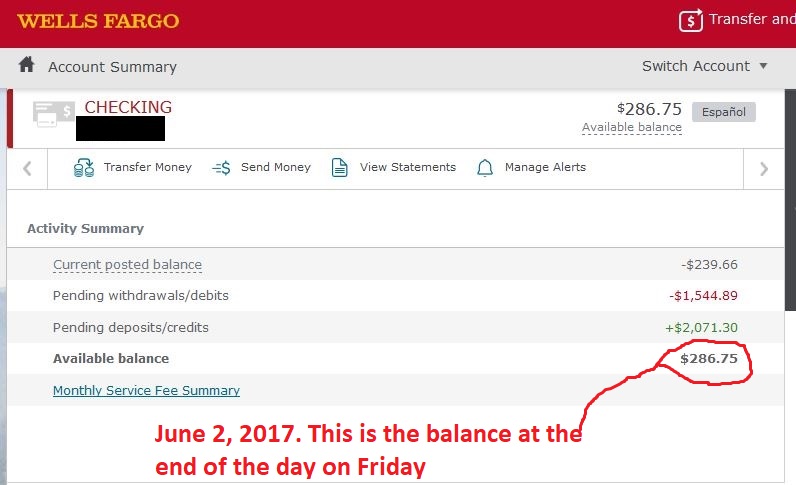

However, whether your credit scores was poor, you are going to acquire fund facing your own Navy Federal bank account or Computer game. This means that the degree of financing you get never exceed the one you have on your checking account. Some of the two money keeps a lengthy cost label out of about fifteen years. The latest installment options are monthly.

Also, safeguarded and you can unsecured personal loans don’t have any origination percentage. And, discover a handling commission or prepayment punishment. not, this new late payment percentage was $29, because the NSF/returned commission percentage is also $30.